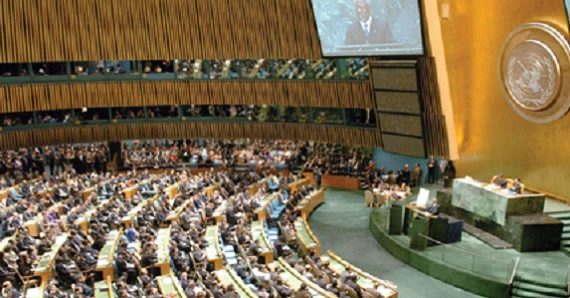

UN General Assembly takes action on Pension Fund

Category : Archives

Following a two-year campaign by staff unions over grave concerns regarding the governance of the Pension Fund and its performance in operations and investments, the UN General Assembly has at last taken action. Passing a resolution (No 71/265) at the end of 2016, the General Assembly has clearly reasserted the UN Secretary General’s primacy over the Fund, confirming the role of the Office of Internal Oversight Services and endorsing the use of existing internal capacities rather than consultants in the operations of the Fund. The resolution further calls on the Fund to improve performance, diversify investments, and minimise foreign exchange losses. It strongly rebuked the Fund administration for allowing key posts in the Investment Management Division to remain vacant (potentially a contributing factor in the underperformance of investments?) and for failing to pay new retirees on time.

The resolution is seen as a first step in addressing the problems besetting the Fund, particularly changes proposed by the CEO, which could have moved the Fund away from UN oversight to an environment potentially more prone to risk, corruption and exploitation by external management companies. Key posts – the heads of investment and risk management – had been vacant for over a year and no performance evaluation of the head of the Fund’s Investment Management Division, had been included in the most recent report on the Fund. Given concerns about performance of the Maryland State Pension Fund during the Chief Investment Officer’s tenure, the vacant key posts and the failure to meet the target of 3.5% annual average return (actual returns since 2014 have been below 2%) this was seen as an important issue.

The UN Pension Fund Board, citing the most recent actuarial report, confirmed in July 2016 that the Fund had a small surplus and would not need to dip into capital for the next 50 years providing the Fund can maintain a 3.5% annual average return – Watch this space!

The Section of Former Officials of the ILO

The Section of Former Officials of the ILO