As all of us are supposed to know, the gross earnings of international civil servants are subject to an internal tax derived from the average of the national income tax rates in headquarters duty stations (Geneva, London, Montreal, New York, Paris, Rome, Vienna).

The UN General Assembly (3rd session, 159th plenary meeting, 18 November 1948, Resolution 239 (III) A, art.7) specifies that the “revenue derived from the [staff] assessment shall be applied as an appropriation-in-aid of the budget”.

In September 2004, the joint SUC/Former Officials’ Section working group on the fiscal system noted that, in some cases, there is double taxation: first, an internal tax on the pension contributions included in gross salary; then taxation of the pensions themselves, which constitute a deferred salary for international civil servants.

How should this problem be tackled?

The ICSC’s solution is, where necessary, to transform the net pension into a gross pension to compensate for any double taxation.

This approach is undoubtedly justified and beneficial for retirees; indeed, it would be a perfect arrangement if it took account of the internal taxation levied on officials – but this is not the case.

In an affirmation of 22 January 2008, the ILO states that the amount of contributions to the UNJSPF (two-thirds by the Organization and one-third by the official) is calculated on the basis of gross earnings (salary, emoluments, SHIF contributions). This gross remuneration is subject to an internal tax schedule corresponding to the average in headquarters duty stations, as indicated above.

This statement – highlighting the risk of double taxation for some retired officials – provides the rationale for the non-taxation of one-third of the pension paid.

It may be recalled that in an article published in 2008, the Union working group on the fiscal system stated that the only correct, justified and perfectly fair solution is the application of the above-mentioned statement by the ILO.

******

Alas, it is clear that not all countries have the same attitude towards the ILO’s statement or the concept of double taxation.

• In Spain, three High Courts of Justice –

Seville (Andalusia), on 17 January 2003,

Madrid, on 23 December 2005, and

Barcelona (Catalonia), on 25 March 2007 –

found that “if earnings are not subject to tax, the same is true of pensions, which are nothing other than a deferred income”.

• Canada and the United States both tax only two-thirds of the pension and therefore respect the ILO’s affirmation.

• Some member States (including France, Japan, Switzerland) do not take the ILO’s affirmation into account, and tax the full pension.

• Other member States do not tax the pension at all.

Take the case of France. In a letter of 17 December 2009, the Conciliateur Fiscal (tax ombudsman) of Haute Savoie states: “The argument you advance, that pensions in payment should be exempt from income tax in France based on the proportion (one-third) of corresponding contributions you previously paid to the UNJSPF during the period of active service, which could not be deducted from the internal tax base as assessed by the ILO, has no bearing on this situation. The principle of taxation in France of pensions received has been confirmed by the highest courts. The fact that part of the contributions which are at the origin of these pensions may have been subject to the ILO’s internal taxation has no bearing on this situation. It rests solely on your relationship with that organization.” We can but take note and assess the situation as follows:

– internal taxes,

– are applied as an appropriation-in-aid of the budget,

and therefore:

– resolving the problem of double taxation is solely the responsibility of the organization concerned.

Still in France, the Ombudsman of the Ministry of Economy and Finance, in a letter dated 3 February 2012, states: “For example, some organizations, notably the so-called Co-ordinated Organisations such as the OECD and the Council of Europe, reimburse their staff a part of the tax paid on pension contributions. They describe this as pension tax adjustment. This choice also results from an internal decision on the part of these organizations.”

The ILO’s affirmation recognizes the reality of the facts, which is normal given the purpose for which the Organization was created, but apparently the relevant departments of this same Organization have forgotten the existence of the “appropriation-in-aid” account… Nor should we forget that the Administrative Tribunal of the ILO recalled in one of its judgements: “Besides, staff assessment is not a system of taxation of staff earnings but a means of avoiding or eliminating the inequalities and discrepancies which would result from taxation by member States.”

It is therefore up to the ILO to honour – and ensure that other organizations honour – the use of this account. All that is required here, in fact, is respect for the decision taken by the UN General Assembly at its 3rd session, 159th plenary meeting (Resolution 239(III)), as applied by various international organizations. It is incomprehensible that no organization applying this correction for active officials has done so for retirees.

Suffice it to say that a rectification is called for (as already declared by the new ILO Director General upon his arrival in 2012):

• It would be normal for the ILO to respect the rights of its pensioners, and remedy the losses incurred by retired staff residing in countries that do not abide by its affirmation of 2008 [1].

• To do so, the ILO should use the account for appropriation-in-aid of the budget.

It is evident that the cost of compensating for the losses suffered by pensioners would be significant. Despite this being the result of errors committed by the organizations themselves, it must be conceded that the total reimbursement of these losses would be impossible for the organizations to achieve. But this in no way justifies their inaction or the persistence of these errors.

For their part, retired staff wish to take account of the reality: the ILO’s 2008 affirmation finally recognizes the facts about their income from the year 2007 on. Despite their losses over many years prior to this, we can assume that retirees would be willing to accept correction as from that date, namely January 2008 for their income from 2007.

To do this, and considering

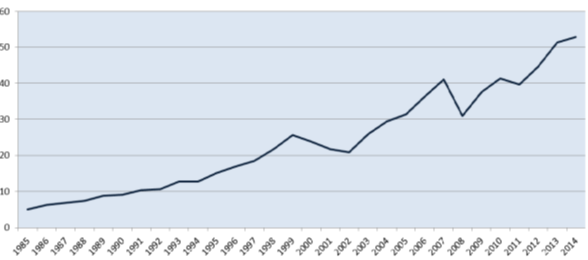

– on one hand, that the real value of the pension paid remains the same, since the only adjustments made are to reflect inflation;

– on the other hand, that the amount to be assessed must be as indicated in the quarterly statements sent to every pensioner by the payments unit of the UNJSPF (the amount set out in the annual certificate delivered at the end of the year is very often different).

Retirees would just have to send the Organization photocopies of their quarterly statements for 2014 (valid for the years 2007 to 2014) for the ILO retroactively to apply the appropriate correction. From 2015 revenues onwards (declaration for 2016), pensioners would submit their photocopied quarterly statements every year and the organization would apply an annual correction accordingly [2].

According to document CCPI-ICS/72/R4 (Doc 3), the internal tax rate is 23.942% of gross (including, of course, contributions to the pension fund). It is therefore this rate that should be taken into account for one-third of the pension paid. The ILO – in accordance with its statement of 2008 – should make reimbursement and attach a “tax adjustment certificate” covering one-third of the pension paid (Doc 7) to obviate any additional tax demand from the country of residence.

To properly address this problem, account should be taken of any change in the salary scale in the event that internal tax is higher than indicated by the ICSC-ICS.

Finally, given the information provided by the Ombudsman of the French Ministry of Economy and Finance (Doc.7), another solution, respecting the current decision taken by the Pension Fund, would be for the latter to pay the net amount of pension for which tax is payable in the country of residence, and separately pay retirees the corrective amount while attaching a “tax adjustment certificate” (Doc.7) to obviate any additional tax demand from the country of residence.

The latter solution would be in conformity with the rights of the Pension Fund, of retired staff and of the organizations concerned.

Obviously, as long as such a solution is not adopted, the ILO’s 2008 declaration should be respected as mentioned above.

Clément Roche, member of the Bureau of the Section of Former Officials, taxation questions

************************************

[1] There is no doubt that in France, for example, upon receipt of the ILO’s statement, many retirees made their 2008 tax declaration (of income received in 2007) either on the basis of two-thirds of the total or for the full amount with the option of a tax credit for one-third; they then will have received a reply from the tax authorities rejecting their declarations and penalizing them with a tax supplement; the latter should therefore also be considered to form part of the tax losses incurred.

[2] Since the tax statement in the country of residence may vary according to whether or not there is additional income, the quarterly statements submitted by UNJSPF retirees are indeed the only correct calculation basis for this exercise.

The Section of Former Officials of the ILO

The Section of Former Officials of the ILO